Decision-making techniques can be classified in terms of decision-making in situations of certainty, uncertainty and risk. In certainty where the outcomes are certain, no decision-making tool is required as the outcomes are certain to occur and hence anyone can take the correct decision (the obvious one). However, decision-making under risk means that the probability values associated with the success and failure of outcomes is known but the outcomes are by no means certain. In these kinds of situations, one can use the decision tree method to take decisions.

We’ll be covering the following topics in this tutorial:

Decision-making under Risk

Decision tree

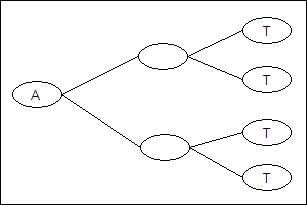

The decision tree method uses an oriented tree or the direction associated tree to represent the decision-making process. The nodes represent points in time, where the decision-maker takes one or the other decision and takes a path or is faced with a state of nature or the decision process terminates. Directed paths emanate out of nodes. These are called branches. They represent the decision branches for possible decisions under a state of nature. Under each branch the probability associated with the success and failure of the event is noted. Decision trees are helpful when probabilities are available for each event and are used to determine optimal decisions. The decision-maker has to first prepare the decision tree and then from the terminal nodes calculate the expected payoff for each path of decision-making by back calculating. The path that gives the maximum payoff is the optimal decision path.

A is the starting node from where the decision-making starts and T are the terminal nodes that represent the possible terminal stages of decision-making. The lines connecting nodes are called branches. As is evident, the branches represent decision paths and probability of success and failure are associated with each branch.

Decision-making under uncertainty means that decision-making is done when the probability about the success or failure of events is not known, unlike in decision-making under risk, where the probability values of success or failure is known. In such circumstances when the probability of occurrence of the states of nature are not known we use.

Decision-making under Uncertainty

Laplace criteria

In this technique equal probabilities are assigned to the possible payoffs and then selection is based on the maximum expected payoff.

For example, if a farmer does not know the probability of high or low rainfall but wants to plant a crop of wheat, rice or bajra for which the expected payoffs are as given below, then Laplace criteria is used in this case as,

Crop | Heavy rainfall H | Low rainfall L | Expected payoff (0.5 x H+0.5 x L)/2 |

Wheat Rice Bajra | 50 60 20 | 30 10 30 | 40 35 25 |

Since wheat gives maximum expected payoff the farmer selects wheat.

This method has been modified by using regret matrix and more refined methods are available like Hurwicz criteria and savage method.

Qualitative tools of decision-making

Some of the qualitative tools of decision-making are:

- Pareto analysis

- Force field analysis

- Six thinking hats technique

- Paired Comparison Analysis

- Plus minus implication

Dinesh Thakur holds an B.C.A, MCDBA, MCSD certifications. Dinesh authors the hugely popular

Dinesh Thakur holds an B.C.A, MCDBA, MCSD certifications. Dinesh authors the hugely popular